Financial Information

Key Figures

A new Key Figures section is under construction. Below some key data from Q2 2022.

Financial Targets

On 5 August 2021, Glaston published its revised strategy and updated its financial targets for the period 2021–2025 and announced new non-financial targets.

The key objectives of the strategy are clearly improved organic growth and profitability, based on Glaston’s own strategic initiatives and the expected market growth.

Glaston’s new financial targets for the strategy period 2021–2025 are:

- Annual average net sales growth (CAGR) clearly exceeding the addressable equipment market growth of more than 5% (1

- Comparable operating margin (EBITA) of 10% at the end of the strategy period (2

- Comparable return on capital employed (ROCE) of 16% at the end of the strategy period (3

1) Glaston estimate, in euros. Glaston’s addressable equipment market is expected to grow on average by more than 5% annually during 2021–2025. The growth rate of the addressable equipment market is expected to exceed that of the global flat glass market, which is expected to grow 3–4 % annually in 2021−2025, according to Grand View Research, 2021.Glaston’s product portfolio is targeting those end-use areas of flat glass that are growing faster than average (e.g. insulating glass). The addressable equipment market also includes the customers’ replacement investments after the operational life of machinery. During 2021−2025, replacement investments will be further derived from productivity gains, especially through automation, as well as technology and regulatory changes. Also, inflation explains part of the difference between volume-based and euro-based market estimates.

2) Calculation of key ratio: Comparable EBITA: Operating result before amortization, impairment of intangible assets and purchase price allocation +/- items affecting comparability

3) Calculation of key ratio: Comparable return on capital employed, % (Comparable ROCE): (Profit/loss before taxes + amortization of purchase price allocations +/- items affecting comparability + financial expenses x 100)/Equity + interest-bearing liabilities, average as of 1 January and end of the reporting period

Guidance

GLASTON SPECIFIES OUTLOOK FOR 2022

(published in the half-year January-June 2022 report on 4 August 2022)

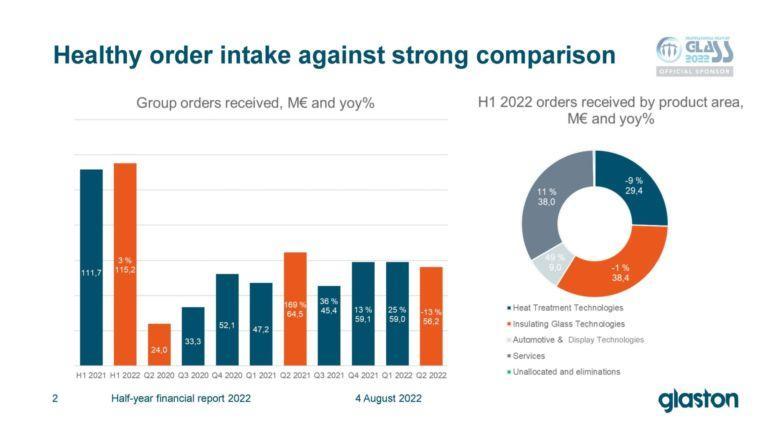

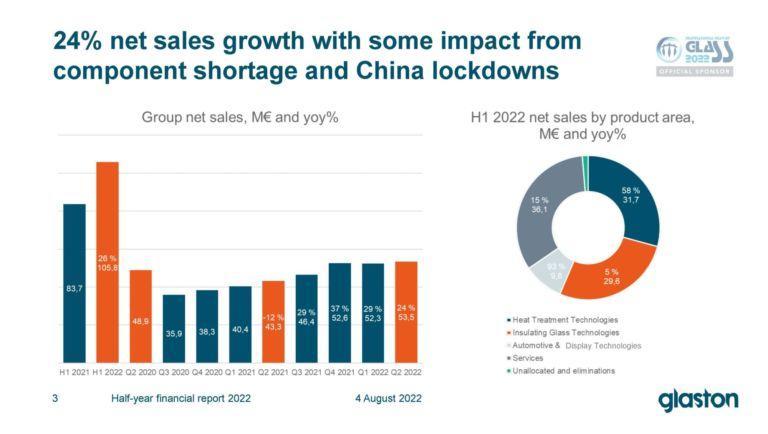

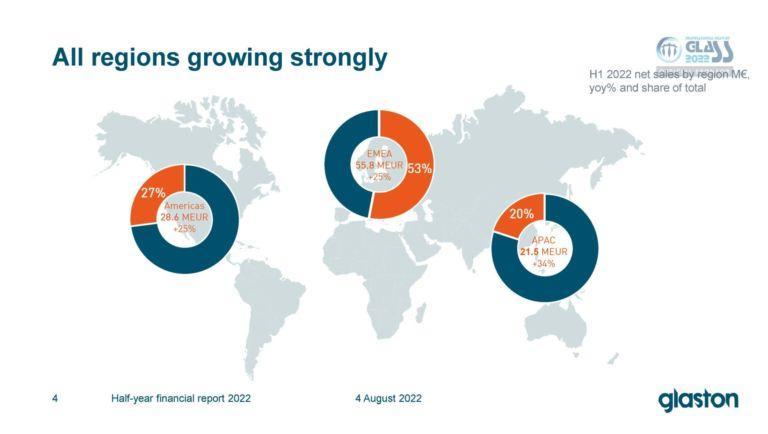

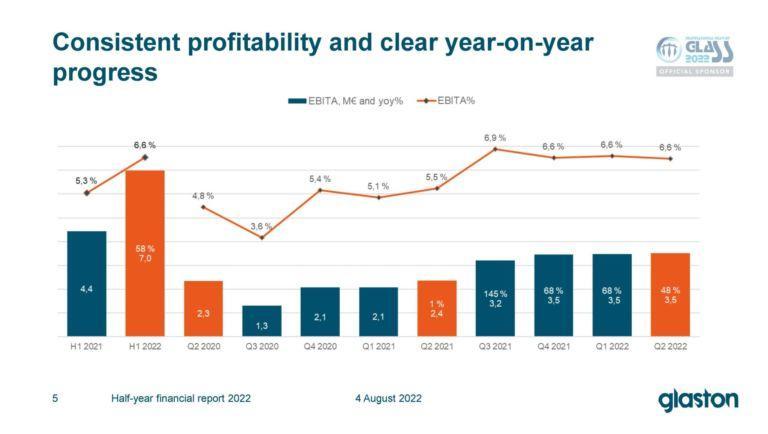

During the first half of 2022, the overall demand in most of Glaston’s markets remained strong, indicating good development for machines and services businesses. In 2022, Glaston’s net sales and profitability development are supported by the solid order backlog at the beginning of the year as well as healthy order intake during the first half of 2022. Costs and capital expenditure related to the execution of the refined Group strategy, announced in August 2021, will occur ahead of the effect on revenue growth.

Currently, higher than usual uncertainty is related to the development of global economic activity and customers’ investments. The uncertainty is driven by, in particular, the supply chain disturbances, which have become a longer-term challenge, and the Russian attack on Ukraine with its implications for energy and raw material prices. The impacts of the still ongoing COVID-19 pandemic add to the uncertainty, especially in China.

Despite the the prevailing uncertainties, Glaston Corporation estimates that its net sales will increase in 2022 from the levels reported for 2021 and specifies its outlook for comparable EBITA, which is estimated to increase to EUR 12−15 million. In 2021, Group net sales totaled EUR 182.7 million and comparable EBITA was EUR 11.1 million.

(Previous outlook: Glaston Corporation estimates that its net sales and comparable EBITA will improve in 2022 from the levels reported for 2021.)

GLASTON’S OUTLOOK FOR 2022

(published in the January-March Interim Report 27 April 2022)

In 2021, Glaston’s markets saw a strong recovery and growth. This positive development continued in the first quarter of 2022, indicating good development for both machines and services business. Glaston started the year with a 48% higher order backlog than in 2021, which supports Glaston’s net sales and profitability development. In 2022, Glaston is focusing on the execution of its strategy, which will incur costs and capital expenditure ahead of the effect on revenue growth.

Currently, higher than normal uncertainty is related to the development of economic activity and customers’ investments. The uncertainty is driven by several simultaneous factors, such as the supply chain disturbances that have become a longer-term challenge, the Russian invasion of Ukraine with its implications on energy and raw material prices, and the still ongoing COVID-19 pandemic.

Despite the prevailing uncertainties, Glaston Corporation expects market development to continue to be positive and estimates that its net sales and comparable EBITA will improve in 2022 from the levels reported for 2021. In 2021, Group net sales totaled EUR 182.7 million and comparable EBITA was EUR 11.1 million.

GLASTON’S OUTLOOK FOR 2022

(as published in the Financial Statements on 14 February 2022)

In 2021, Glaston’s markets saw a continued recovery and strong growth. We expect positive development to continue in 2022 with good progress for both machines and services business. At the start of 2022, our order backlog was 48% higher than the previous year providing a strong starting point for 2022 and supporting Glaston’s net sales and profitability development. In 2022, Glaston will focus on the execution of its strategy which will incur costs and capital expenditure ahead of the effect on revenue growth. As the COVID-19 pandemic continues and supply chain disturbances have become a longer-term challenge, a higher than normal uncertainty is related to the development of economic activity and customers’ investments.

Glaston Corporation estimates that its net sales and comparable EBITA will improve in 2022 from the levels reported for 2021. In 2021, Group net sales totaled EUR 182.7 million and comparable EBITA was EUR 11.1 million.

GLASTON’S OUTLOOK FOR 2021 REMAINS UNCHANGED

as published in the Q3 2021 interim report, 28 October 2021

From January−September, orders received saw a healthy recovery, indicating positive development for both the machines and services business throughout 2021. As anticipated, after the record high second-quarter order intake, order intake returned to pre-COVID-19 levels in the third quarter.

Glaston expects the heat treatment and insulating glass technology markets to continue to perform well during the rest of the year. In the short term, demand for automotive glass processing technology has shown some recovery but remains volatile due to structural changes and supply chain driven challenges in the market. Generally, there is higher than normal level of uncertainty associated with the outlook due to increased component prices and delivery times.

Based on the high order intake since the fourth quarter of 2020, Glaston Corporation estimates that its net sales in 2021 will improve from the level reported for 2020 and comparable EBITA will increase to EUR 10.5−12.5 million. In 2020, Group net sales totaled EUR 170.1 million and comparable EBITA was EUR 7.7 million.

Glaston’s outlook as published in the Q1 2021 interim report published on 29 April 2021:

The strong recovery in orders received in the fourth quarter of 2020 and its continuation in the first quarter of 2021 indicate positive development for both the machines and services business throughout 2021. Glaston started 2021 with a 20% lower order backlog than the previous year, impacting net sales and comparable operating profit for the first half of 2021. The second half of 2021 will benefit from the order intake recovery. Glaston expects the heat treatment and insulating glass technology markets to perform well, but visibility continues to be shorter than normal due to the COVID-19 pandemic and its implications on economic activity, investments and travel restrictions. The demand for automotive glass processing technology is volatile and uncertain due to COVID-19, structural changes in the market and automotive supply chain disruptions.

Based on the expected continued positive market development, Glaston Corporation estimates, that its net sales and comparable EBITA will improve in 2021 from the levels reported for 2020. In 2020, Group net sales totaled EUR 170.1 million and comparable EBITA was EUR 7.7 million.

GLASTON’S OUTLOOK FOR 2021

published on 9 February 2021:

The strong recovery in orders received towards the end of 2020 and continued positive market environment during the first weeks of 2021 indicate positive development for both the machines and services business throughout 2021. However, reflecting the lower order intake in 2020 compared to the previous year, Glaston will start 2021 with a 20% lower order backlog than the previous year. This will impact on Glaston’s net sales and comparable operating profit for the first half of 2021. The uncertainty related to the pace and extent of market recovery continues to be higher than normal due to the COVID-19 pandemic and its implications on economic activity, investments and travel restrictions.

Based on the expected continued market recovery, Glaston Corporation estimates, that its net sales and comparable EBITA will improve in 2021 from the levels reported for 2020. In 2020, Group net sales totaled EUR 170.1 million and comparable EBITA was EUR 7.7 million.

GLASTON’S OUTLOOK FOR 2020 REMAINS UNCHANGED

published on 27 October 2020 in the Q3 2020 interim report:

Glaston Corporation estimates that comparable EBITA for 2020 will decline from the 2019 level. The company’s current assessment is that fourth-quarter orders will improve from the third quarter but remain below the previous year’s levels. The lower than 2019 order intake and lower than normal volume in services business impacts the development of net sales and earnings in 2020. The uncertainty surrounding the assessment remains, and the situation might change quickly depending on the development of the COVID-19 pandemic and the general economic climate.

GLASTON’S OUTLOOK FOR 2020 UNCHANGED,

as communicated in the January-June 2020 Half-Year Financial Report on 6 August 2020:

Glaston Corporation estimates that comparable EBITA for 2020 will decline from the 2019 level. The company’s current assessment is that the market will recover gradually and that third- and fourth-quarter orders will improve from the second quarter but stay below the previous year’s levels. The lower than 2019 order intake and slower than normal volume in services business impacts the development of net sales and earnings in 2020. The uncertainty surrounding the assessment remains, and the situation might change quickly depending on the development of the COVID-19 pandemic and the general economic climate.

Glaston’s outlook as in the January-March 2020 interim report, published on 28 April 2020:

GLASTON’S OUTLOOK FOR 2020 UPDATED

Glaston Corporation estimates that comparable EBITA for 2020 will decline from the 2019 level. Due to low visibility and rapid market movements, the extent of the decline cannot be reliably assessed at this stage. The company’s current assessment is that orders received in the second and third quarters will be at a lower level than normal. The postponement of the delivery of some orders will impact the development of net sales and earnings in the near future. Exceptionally high uncertainty surrounds the assessments, and the situation might change very quickly.

On 20 March 2020, Glaston Corporation published a stock exchange release which stated that, due to the significant deterioration in the global financial situation following the coronavirus situation and the rapid changes in the company’s business environment, Glaston was withdrawing its guidance issued on 11 February 2020 and that it was improbable that company’s comparable EBITA will grow in 2020.

GLASTON’S OUTLOOK FOR 2020 as communicated on 20 March 2020:

Glaston Corporation comparable EBITA unlikely to improve in 2020

Due to the significant deterioration in the global financial situation following the coronavirus and the rapid changes in the company’s business environment Glaston withdraws its guidance for the 2020 outlook, in which it expected the 2020 comparable EBITA to improve from the 2019 level.

Due to the weak visibility and high market volatility Glaston has decided to suspend its outlook for 2020. The company’s aim is to give an update on the outlook once a more reliable estimate on the potential impact can be made.

GLASTON’S OUTLOOK FOR 2020,

published in the Financial Statements Bulletin on 11 February 2020

Glaston Corporation expects that 2020 comparable pro forma EBITA will improve from the 2019 level (2019 comparable pro forma EBITA EUR 12.1 million).

GLASTON’S OUTLOOK FOR 2019 UNCHANGED (published in Glaston’s Q3/2019 interim report on 28 October 2019)

Glaston Corporation expects that 2019 comparable pro forma EBITA will be at the 2018 level or will improve slightly on it (2018 comparable pro forma EBITA EUR 11.5 million).

At the end of 2018, Bystronic glass had a significant number of orders that were recognized as revenue in the second and third quarters of 2019, thereby improving Bystronic glass’ actual net sales and profitability. Bystronic glass’ fourth quarter net sales and profitability will be significantly lower than in the early part of the year. The Glaston segment’s result is skewed towards the second half of the year.

Outlook for 2019 as in Glaston’s Q1/2019 Interim Report, published on 29 April 2019:

Bystronic glass will be consolidated as part of Glaston Corporation from 1 April 2019 and consequently, Glaston will have two reporting segments: Glaston and Bystronic glass. The Company estimates the acquisition to be earnings enhancing, also in terms of comparable earnings per share when compared to the situation excluding the acquisition. As stated in the stock exchange release, published on 12 February 2019, the Company will disclose information regarding its 2019 full-year outlook at a later stage. In addition, Glaston plans to publish Glaston’s and Bystronic glass’ unaudited combined financial information for 2018 and the first quarter of 2019 at the latest in connection with the planned rights issue, which is expected to begin during the second quarter of 2019.

Some of Glaston’s (excluding Bystronic glass) orders received in the latter part of 2018 will be delivered in the second half of the year, which will shift net sales and operating result to later than normal.

Glaston’s Outlook 2019, as published in Glaston’s 2018 Financial Statement Bulletin on 12 February 2019:

The company’s business is seasonal and, historically, the first quarter of the year is generally the weakest and the fourth quarter the strongest. Net sales and comparable operating profit are expected to be low for the first quarter of 2019, due to the low number of new orders received in the third quarter and the beginning of the fourth quarter of last year.

Deviating from Glaston’s disclosure policy and due to the timetable of the Bystronic glass acquisition, Glaston will disclose information on its outlook for the whole of 2019 at a later stage.

Outlook as in Glaston’s January-September 2018 Interim Report, published on 31 October 2018:

Glaston’s outlook is unchanged. We expect the full-year comparable operating profit to improve from 2017. (Full-year 2017 comparable operating profit was EUR 5.0 million according to the new revenue recognition standard IFRS 15).

Outlook as in Glaston’s January-June 2018 Half-year report on 9 August 2018:

The order intake in the early part of the year and the positive market development create good conditions for profitable growth in 2018. Due to the weighting of the order intake forecast towards the second half of the year, the operating profit for the final quarter of the year is expected to be significantly better than the other quarters.

We expect the full-year comparable operating profit to improve from 2017. (Full-year 2017 comparable operating profit was EUR 5.0 million according to the new revenue recognition standard IFRS 15).

Outlook as in Glaston’s January-March 2018 Interim Report, published on 23 April 2018:

Activity in the glass processing market was good from the beginning of 2018. The development of Glaston’s order intake took a turn for the better as the end of the quarter approached, and the positive market development is expected to continue. The strong growth expectations for the world economy support this view. Customers continue to take time over their investment decisions, which may cause delays in orders and fluctuations in quarterly order intake.

The steady order intake of the previous six months and positive market development create good conditions for profitable growth in 2018. We expect the full-year comparable operating profit to improve from 2017. (Full-year 2017 comparable operating profit was EUR 5.0 million according to the new revenue recognition standard IFRS 15).

As in Glaston’s Financial Statements Bulletin, published on 8 February 2018:

The development of the glass processing market gradually improved during 2017, and Glaston expects the positive development to continue in the current year. The strong growth expectations for the world economy support this view. Customers continue to take time over their investment decisions, which may cause delays in orders and fluctuations in quarterly order intake.

Although the order book at the end of 2017 was lower than the previous year, the good order intake of the second half of the year and positive market development create good conditions for profitable growth in 2018. We expect the full-year comparable operating profit to improve from 2017. (Full-year 2017 comparable operating profit was EUR 5.4 million.)

As in Glaston’s January-September 2017 Interim Report, published on 30 October 2017:

Outlook revision

In the third quarter, the development of the glass processing market continued to be mainly positive. The prolonged uncertainty in the global economy and increasing political tensions in some regions are impacting customers’ willingness to invest, and decision-making times have lengthened. There are no visible signs of a permanent change in the market, however. We expect the positive market development to continue.

Glaston’s January–September comparable operating result was EUR 2.8 million, i.e. at the same level as the whole of 2016. Previously, the full-year 2017 comparable operating result was expected to improve from 2016.

Glaston revises its outlook and now expects the full-year 2017 comparable operating result to be EUR 4.0–5.5 million. (Previous outlook: We expect the full-year comparable operating result to improve from 2016. In 2016 the comparable operating result was EUR 2.8 million.)

As in Glaston’s Half Year Financial Report published on 10 August 2017:

Outlook unchanged

After a quiet first quarter, the glass processing market became more active to some extent in the second quarter. The prolonged uncertainty in the global economy and increasing political tensions in some regions are impacting customers’ willingness to invest, and decision-making times have lengthened. There are no visible signs of a permanent change in the market, however. We expect the positive market development to continue.

Good order book at start of the year, positive market development and the cost-saving measures undertaken create good conditions for the development of operations in 2017. We expect the full-year comparable operating result to improve from 2016. (In 2016 the comparable operating result was EUR 2.8 million.)

As in Glaston’s Interim Report published on 26 April 2017:

In the first quarter of 2017, the glass processing market was quiet, as anticipated. The prolonged uncertainty in the global economy and increasing political tensions in some regions will impact customers’ willingness to invest, and decision-making times have lengthened. There are no visible signs of a permanent change in the market, however. We expect that positive market development will still continue.

A higher order book than the previous year, positive market development and the cost-saving measures undertaken create good conditions for the development of operations in 2017. We expect the full-year comparable operating result to improve from 2016. (In 2016 the comparable operating result was EUR 2.8 million.)

As in Glaston’s Financial Statements Bulletin, published on 10 February 2017:

The development of the glass processing market was positive at the end of 2016. There are currently no signs of a weakening of the market, and positive development is expected to continue. Despite good demand, customers are often taking longer to make their investment decisions due to the uncertain global economy and political developments.

A higher order book than the previous year, positive market development and the cost-saving measures undertaken create good conditions for the development of operations in 2017. For the first quarter, a relatively small number of deliveries are scheduled, as a result of which the comparable operating result for the period is expected to be lower than the corresponding period a year earlier.

Glaston expects the full-year comparable operating result to improve from 2016. (In 2016 the comparable operating result was EUR 2.8 million.)

As in Glaston’s Financial Statement Bulletin 2015, published on 11 February 2016:

In the final quarter of 2015, signs of caution appeared in Glaston markets. Looking at 2016, we expect the overall market to develop positively but cautiously.

We expect the North American market to continue to develop well also in 2016. We expect the EMEA area to develop positively. In Asia, we expect the Chinese market to remain stable at its current level, and we expect growth in the Pacific area.

The heat treatment machines market will continue to be reasonably subdued. We expect that demand for new heat treatment machines will be weaker than the previous year during the early part of the year. Despite a challenging market outlook, Glaston’s position in the market is good. Our wide product range corresponds excellently with customers’ needs. As the technology leader, we will continue our goal-oriented development work, in which digitalisation and new technologies will present new business opportunities.

The outlook for the services market is cautiously positive. Our growth objectives are supported by Glaston’s strong market position, comprehensive service network and up-to-date product range.

Due to the subdued market situation and reduced order book, we expect 2016 net sales to be slightly below the 2015 level. We expect the operating profit, excluding non-recurring items, to be at the 2015 level. (In 2015 net sales were EUR 123.4 million and operating profit, excluding non-recurring items, was EUR 6.1 million).

Dividend

| 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | |

| Dividend per share | 0.03*) | 0.02*) | - | 0.03*) | 0.01*) | - | 0.01*) | 0.02*) | 0.01 |

| Extra dividend per share | - | - | - | - | - | - | - | ||

| Total dividend | - | 0.03 | 0.01 | - | 0.01 | 0.02 | 0.01 |

*) return of capital

Dividend policy

According to Glaston’s dividend policy Glaston’s objective is to distribute annually a dividend or return of capital amounting to 30-50% of the company’s comparable earnings per share.

When determining the amounts and dates of payment of any future dividends or returns of capital the Board of Directors always takes the company’s financial position and future outlook into consideration. In addition, the dividend policy takes into account growth targets in line with strategy as well as financing requirements for growth.

Accounting Principles

Glaston Corporation is a public limited liability company organized under the laws of the Republic of Finland and domiciled in Helsinki, Finland. Glaston’s shares are publicly traded in Nasdaq Helsinki Ltd. Small Cap in Helsinki, Finland. Glaston Corporation is the parent of Glaston Group and its registered office is at Lönnrotinkatu 11, 00120 Helsinki, Finland.

Glaston Group is an international glass technology company. Glaston is one of the leading manufacturers of glass processing machines globally. Its product range and service network are the most extensive in the industry. The operations of Glaston Group are organized in three reportable segments which consists of operating segments.

The consolidated financial statements of Glaston Group are prepared in accordance with International Financial Reporting Standards (IFRS), including International Accounting Standards (IAS) and Interpretations issued by the International Financial Reporting Interpretations Committee (SIC and IFRIC). International Financial Reporting Standards are standards and their interpretations adopted in accordance with the procedure laid down in regulation (EC) No 1606/2002 of the European Parliament and of the Council. The Notes to the Financial Statements are also in accordance with the Finnish Accounting Act and Ordinance and the Finnish Companies‘ Act.

The consolidated financial statements include the financial statements of Glaston Corporation and its subsidiaries. The functional and reporting currency of the parent is euro, which is also the reporting currency of the consolidated financial statements. Functional currencies of subsidiaries are determined by the primary economic environment in which they operate.

The financial year of Glaston Group as well as of the parent and subsidiaries is the calendar year ending 31 December.

The financial statements have been prepared under the historical cost convention except as disclosed in the accounting policies below. The figures in Glaston’s consolidated financial statements are mainly presented in EUR thousands. Due to rounding differences the figures presented in tables do not necessarily add up to the totals of the tables.

In addition to the standards and interpretations presented in the financial statements for 2020, the Group will adopt IFRS standards, IFRIC interpretations and changes to existing standards and interpretations that enter into effect in 2021. Management estimates that these will have no material effect on Glaston’s consolidated financial statements.

The consolidated financial statements include the parent and its subsidiaries. Subsidiaries are companies in which the parent has, based on its holding, more than half of the voting rights directly or via its subsidiaries or over which it otherwise has control. Divested subsidiaries are included in the consolidated financial statements until the control is lost, and companies acquired during the reporting period are included from the date when the control has been transferred to Glaston. Acquisitions of subsidiaries are accounted for under the purchase method.

Associates, where the Group has a significant influence (holding normally 20–50 per cent), are accounted for using the equity method. The Group’s share of the associates‘ net results for the financial year is recognized as a separate item in profit or loss. The Group’s interest in an associate is carried in the statement of financial position at an amount that reflects its share of the net assets of the associate together with goodwill on acquisition, if such goodwill exists. When the Group’s share of losses exceeds the carrying amount of associate, the carrying amount is reduced to nil and recognition of further losses ceases unless the Group is committed to satisfy obligations of the associate by guarantees or otherwise. Glaston Group has no associates in years 2020 and 2019.

Other shares, i.e. shares in companies in which Glaston owns less than 20 percent of voting rights, are classified as assets recognized at fair value through other comprehensive income, or if the fair value cannot be measured reliably, at acquisition cost, and dividends received from them are recognized in profit or loss.

All inter-company transactions are eliminated as part of the consolidation process. Unrealized gains arising from transactions with associates are eliminated to the extent of the Group’s interest in the entity. Unrealized losses are eliminated in the similar way as unrealized gains, but only to the extent that there is no evidence of impairment.

Non-controlling interests are presented separately in arriving at the net profit or loss attributable to owners of the parent. They are also shown separately within equity. If the Group has a contractual obligation to redeem the share of the non-controlling interest with cash or cash equivalents, non-controlling interest is classified as a financial liability. The effects of the transactions made with non-controlling interests are recognized in equity, if there is no change in control. These transactions do not result in goodwill or gains or losses. If the control is lost, the possible remaining ownership share is measured at fair value and the resulting gain or loss is recognized in profit or loss. Total comprehensive income is attributed also to non-controlling interest even if this will result in the non-controlling interest having a deficit balance.

In the consolidated financial statements, statements of profit or loss, statements of comprehensive income and statements of cash flows of foreign subsidiaries have been translated into euros using the average exchange rates of the reporting period and the statements of financial positions have been translated using the closing exchange rates at the end of the reporting period.

The exchange difference arising from translating the statements of profit or loss, statements of comprehensive income and statements of financial position using the different exchange rates is recognized as other comprehensive income and included in equity as cumulative exchange difference. Exchange differences arising from the translation of the net investments in foreign subsidiaries and associates in non-euro-area are also recognized in other comprehensive income and included in equity as cumulative exchange difference.

On the disposal of all or part of a foreign subsidiary or an associate, the cumulative amount or proportionate share of the exchange difference is reclassified from equity to profit or loss as a reclassification item in the same period in which the gain or loss on disposal is recognized.

In their own day-to-day accounting the Group companies translate transactions in foreign currencies into their own reporting or functional currency at the exchange rates prevailing on the dates of the transactions. At the end of the reporting period, the unsettled balances of foreign currency transactions are measured at the exchange rates prevailing at the end of the reporting period. Foreign exchange gains and losses arising from trade receivables are entered as adjustments of net sales and foreign exchange gains and losses related to trade payables are recorded as adjustments of purchases. Foreign exchange gains and losses arising from financial items are recorded as financial income and expenses.

Glaston’s financial assets have been classified into three categories: as assets recognized at amortized cost, at fair value through other comprehensive income and at fair value through profit or loss. The classification depends on the business model under which the financial assets are managed as well as the characteristics of the instrument’s cash flows. A financial asset item is derecognized from the statement of financial position when Glaston’s contractual right to the cash flows from the financial asset item expire or the financial asset item is transferred to an external party and the transfer fulfills the asset derecognition requirements of IFRS 9.

Financial liabilities are classified at amortized cost using the effective interest method, or at fair value through profit or loss. A financial liability or part of a financial liability is derecognized from the statement of financial position when the liability has ceased to exist, i.e. when the obligation specified in the contract has been discharged or canceled or has expired.

Derivative contracts are entered in the statement of financial position at the time of acquisition at fair value and remeasured at fair value in the financial statements using the market prices at the end of the reporting period. Entries of the changes of derivatives are influenced by whether a derivative contract falls within the scope of hedge accounting. Derivatives that do not meet the hedge accounting conditions are financial assets and liabilities acquired for trading and entered at fair value through profit or loss, and whose changes of value are recognized immediately through profit or loss.

When a hedging arrangement is entered into, the relationship between the item being hedged and the hedging instrument, as well as the objectives of the Group’s risk management are documented. The IFRS 9 standard requires an economic relationship between the hedged item and the hedging instrument as well as the same hedge ratio that management actually uses in risk management.

If the hedging accounting conditions are met, cash flow hedge accounting under IAS 9 is applied with respect to foreign exchange derivatives. If the hedge accounting conditions are not met, the result of hedging instruments when hedging a commercial foreign exchange risk are recognized in profit or loss within other operating income or expenses.

Derivative instruments are included in the statement of financial position in current assets and liabilities. Trade date accounting is used in recognizing sales and purchases of derivatives.

In reporting periods 2020 and 2019, hedge accounting was used in hedging the trade receivables of projects. At the end of reporting periods 2020 and 2019, Glaston had open foreign exchange forward contracts.

Other assets recognized at fair value through profit or loss may include current investments that are acquired and held for trading, i.e. acquired or incurred for the main purpose of selling them in the short term. Other assets recognized at fair value through profit or loss are included in current assets in the statement of financial position.

Fair values of other financial assets recognized at fair value through profit or loss are estimated to correspond to their carrying amounts because of their short maturities. Trade date accounting is used in recognizing purchases and sales of other assets recognized at fair value through profit or loss.

Loans and other receivables are assets which are not included in derivative assets. Loans and other receivables arise when money, goods or services are delivered to a debtor. They are not quoted in an active market and payments related to them are either fixed or determinable. Loans and receivables granted by the Group are measured at amortized cost.

Loan receivables, trade receivables and other receivables have been classified as loans and other receivables. They are included in current or non-current financial assets in accordance with their maturity. Loan and trade receivables falling due after 12 months are discounted, if no interest is charged separately, and the increase in the receivable which reflects the passage of time is recognized as interest income in financial income and expenses.

Trade receivables are carried at the original invoice amount less the share of the discounted interest and an estimate made for doubtful receivables. The estimate made for doubtful receivables is based on a review of all trade receivables outstanding on the reporting date as well as on an assessment of the impairment of financial assets based on expected credit losses. Impairment losses of trade receivables are recorded in a separate allowance account within trade receivables, and the impairment losses are recognized in profit or loss as other operating expenses. If the impairment loss is final, the trade receivable is derecognized from the allowance account. If a payment is later received from the impaired receivable, the received amount is recognized in profit or loss as a deduction of other operating expenses. If no impairment loss has been recognized in allowance account and the impairment loss of the trade receivable is found to be final, impairment loss is recognized directly as deduction of trade receivables.

Loan receivables are carried at the original amount less an estimate made for doubtful receivables. The estimate made for doubtful receivables is based on a separate review of all loan receivables outstanding on the reporting date as well as on an assessment of the impairment of financial assets based on expected credit losses. For example, payment defaults or late payments are considered as indications of impairment of the receivable. Impairment losses of loan receivables are recognized in profit or loss as financial expenses. If a payment is later received from the impaired receivable, the received amount is recognized in profit or loss in financial items.

Financial assets measured at fair value through other comprehensive income are financial assets not included in derivative assets, assets or liabilities recognized at fair value through profit or loss, or other receivables.

Listed investments included in financial assets measured at fair value through other comprehensive income are valued at the market price at the end of the reporting period. Investments whose fair value cannot be reliably determined, such as unlisted shares and other investments, are stated at acquisition cost or lower if an impairment loss is recognized for the investment.

Unrealized changes in the fair value of financial assets measured at fair value through other comprehensive income are recognized in other comprehensive income less tax effects and are included in the fair value reserve in equity.

Financial assets at fair value through other comprehensive income are included in non-current assets in the statement of financial position.

Cash and cash equivalents comprise cash and other financial assets. Other financial assets are highly liquid investments with remaining maturities at the date of acquisition of three months or less. Bank overdrafts are included in current interest-bearing liabilities.

On initial recognition financial liabilities are measured at their fair values that are based on the consideration received. Subsequently, financial liabilities are measured at amortized cost using the effective interest method. Transaction costs are included in the acquisition cost.

Financial liabilities measured at amortized cost include pension loans, loans from financial institutions, finance lease liabilities, debenture bond, trade payables and advances received. They are included in current or non-current liabilities in accordance with their maturity.

Interest expenses are accrued for and mainly recognized in profit or loss for each period. If an asset is a qualifying asset as defined in IAS 23 Borrowing Costs, the borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset are capitalized to the acquisition cost of the asset. The capitalization applies mainly to property, plant and equipment and intangible assets.

Net sales include the total invoicing value of products sold and services provided less discounted interest and sales tax, cash discounts and rebates. Foreign exchange differences arising from trade receivables are recognized as sales adjustments.

Revenue from the sale of goods is recognized at a specific date or within a certain period, according to when the buyer receives the goods or gains control. Normally, this takes place at the date of the delivery in accordance with the terms of delivery. Revenue from services rendered and repair work is recognized when the service has been rendered or the work has been completed. Revenue is recognized in an amount that reflects the consideration to which the entity expects to be entitled in exchange for goods delivered or services rendered.

In satisfying the terms of IFRS 15, Glaston recognizes the revenue from tailor-made glass processing machine deliveries over time (partial revenue recognition). As a revenue recognition practice, Glaston applies the cost-to-cost method, i.e. the share of accumulated project costs compared to total estimated costs is used as the degree of completion. Revenue recognition takes place over time, according to when costs accumulate and are recognized for the project.

The Group has various pension plans in accordance with the local conditions and practices in the countries where it operates. The pension plans are classified as defined contribution plans or defined benefit plans. The payments to the schemes are determined by actuarial calculations.

The contributions to defined contribution plans are charged to profit or loss in the period to which the contributions relate.

The obligations for defined benefit plans have been calculated separately for each plan. Defined benefit liabilities or assets, which have arisen from the difference between the present value of the obligations and the fair value of plan assets, have been entered in the statement of financial position.

The defined benefit obligation is measured as the present value of the estimated future cash flows using interest rates of government securities that have maturity terms approximating the terms of related liabilities or similar long-term interests.

For the defined benefit plans, costs are assessed using the projected unit credit method. Under this method the cost is charged to profit or loss so as to spread over the service lives of employees.

According to the standard Glaston records actuarial gains and losses in other comprehensive income. Only current and past service costs as well as net interest on net defined benefit liability can be recorded in profit or loss. Other changes in net defined benefit liability are recognized in other comprehensive income with no subsequent recycling to profit or loss.

Glaston Corporation has share-based incentive plans for the Group’s key personnel. Depending on the plan, the reward is settled in shares, cash, or a combination thereof, provided that the key employee’s employment or service with the Group is in force and the criteria for the performance is fulfilled. If a key employee’s employment or service with the Group ends before the payment of a reward, the main principle is that no reward will be paid.

The granted amount of the incentive plans settled in shares is measured at fair value at the grant date, and the cash-settled part of the plans is measured at fair value at the reporting or payment date.

The expenses arising from the incentive plans are recognized in profit or loss during the vesting periods. The cash-settled portion of the incentive plans is recorded as a liability in the statement of financial position, if it has not been paid, and the portion settled in shares is recorded in retained earnings in equity net of tax. Glaston records the personnel costs arising from the share-based incentive plans to the extent it is liable to pay them. The share-based incentive plans are described in Note 30 to the consolidated financial statements.

The consolidated financial statements include current taxes, which are based on the taxable results of the group companies for the reporting period together with tax adjustments for previous reporting periods, calculated in accordance with the local tax rules, and the change in the deferred tax liabilities and assets.

Income taxes which relate to items recognized in other comprehensive income are therefore recognized in other comprehensive income.

The Group’s deferred tax liabilities and assets have been calculated for temporary differences, which have been obtained by comparing the carrying amount of each asset or liability item with their tax bases. Deferred tax assets are recognized for deductible temporary differences and tax losses to the extent that it is probable that taxable profit will be available, against which tax credits and deductible temporary differences can be utilized. In calculating deferred tax liabilities and assets, the tax rate used is the tax rate in force at the time of preparing the financial statements or which has been enacted by end of the reporting period.

Principal temporary differences arise from depreciation and amortization of property, plant and equipment and intangible assets, defined benefit plans, recognition of net assets of acquired companies at fair value, through other comprehensive income and derivative instruments at fair value, inter-company inventory profits, share-based payments and confirmed tax losses.

Items affecting comparability are adjusted for non-business transactions or changes in valuation items when they arise from restructuring, acquisitions and disposals, related integration and separation costs, sale or impairment of assets. These may include staff reductions, rationalization of the product range, restructuring of the production structure, and reduction of premises.

Impairment losses on goodwill, gains or losses on disposals due to changes in the group structure, exceptionally large gains or losses on tangible and intangible assets, exceptional compensations for damages and legal proceedings are restated as an item affecting comparability. Additionally large gains or losses on tangible and intangible assets, exceptional compensations for damages and legal proceedings are restated as an item affecting comparability.

Intangible asset is recognized in the statement of financial position if its cost can be measured reliably and it is probable that the expected future economic benefits attributable to the asset will flow to the Group. Intangible assets are stated at cost and amortized on a straight line basis over their estimated useful lives. Intangible assets with indefinite useful life are not amortized, but tested annually for impairment.

Acquired intangible assets recognized as assets separately from goodwill are recorded at fair value at the time of the acquisition of the subsidiary.

The estimated useful lives for intangible assets are as follows:

Computer software, patents,

licenses, trademarks, product rights 3-10 years

Capitalized development expenditure 5-7 years

Other intangible assets 5-10 years

Research costs are expensed as incurred. Expenditure on development activities, whereby research findings are applied to a plan or design for the production of new or substantially improved products, is capitalized if the product is technically and commercially feasible and the Group has sufficient resources to complete development and to use or sell the intangible asset. Amortization of the capitalized expenditure starts when the asset is available for use. The intangible assets not yet available for use are tested annually for impairment. Research expenditure and development expenditure recognized in profit or loss are recognized in operating expenses.

Borrowing costs are capitalized as part of the acquisition cost of intangible assets if the intangible assets are qualifying assets as defined in IAS 23 Borrowing Costs. In 2020 or 2019 Glaston did not have any qualifying assets.

Goodwill represents the excess of the acquisition cost over fair value of the assets less liabilities of the acquired entity. Goodwill arising from the acquisition of foreign entities of acquisitions is treated as an asset of the foreign entity and translated at the closing exchange rates at the end of the reporting period.

Acquisitions have been recognized in accordance with IFRS 3. Purchase consideration has been allocated to intangible assets, if they have met the recognition criteria stated in IAS 38 (Intangible Assets).

In accordance with IFRS 3 Business Combinations, goodwill is not amortized. The carrying amount of goodwill is tested annually for impairment. The testing is made more frequently if there are indications of impairment of the goodwill. Any possible impairment loss is recognized immediately in profit or loss.

Glaston’s goodwill has been allocated to the cash generating units of the group.

Property, plant and equipment are stated at historical cost less accumulated depreciation and impairment losses. The cost of self-constructed assets includes the cost of materials, direct labor and an appropriate proportion of production overheads. When an asset consists of major components with different useful lives, they are accounted for as separate items. Assets from acquisition of a subsidiary are stated at their fair values at the date of the acquisition.

Depreciation is recorded on a straight-line basis over expected useful lives. Land is not depreciated since it is deemed to have indefinite useful life.

The most common estimated useful lives are as follows:

Buildings and structures 25-40 years

Heavy machinery 10-15 years

Other machinery and equipment 3-5 years

IT equipment 3-10 years

Other tangible assets 5-10 years

The buildings include the investment property which is part of the plant situated in Tianjin, China. This is reported as investment property and has been leased since 2016 under a 10-year agreement.

Gain on the sale of property, plant and equipment is included in other operating income and loss in operating expenses.

The costs of major inspections or the overhaul of property, plant and equipment items, that occur at regular intervals and are identified as separate components, are capitalized and depreciated over their useful lives. Ordinary maintenance and repair charges are expensed as incurred.

Borrowing costs are capitalized as part of the acquisition cost of tangible assets if the tangible assets are qualifying assets as defined in IAS 23 Borrowing Costs. In 2020 or 2019 Glaston did not have any qualifying assets.

A discontinued operation is a segment or a unit representing a significant geographical area, which has been disposed of or is classified as held for sale. The profit for the period attributable to the discontinued operation is presented separately in the consolidated statement of profit or loss. Also post-tax gains and losses recognized on the measurement to fair value less costs to sell or on the disposal of the asset or disposal group are presented in the statement of profit or loss as result of discontinued operations. Comparative information has been restated.

Non-current assets or disposal groups are classified as held for sale and presented separately in the statement of financial position if their carrying amounts will be recovered principally through a sale transaction rather than through continuing use. In order to be classified as held for sale the asset or disposal group must be available for immediate sale in its present condition and the sale must be highly probable. In addition, the sale should qualify for recognition of a complete sale within one year from the date of the classification.

An asset classified as held for sale is measured at the lower of its carrying amount and fair value less costs to sell and it is not depreciated or amortized.

Also liabilities of a disposal group classified as held for sale are presented separately from other liabilities in the statement of financial position.

IFRS 5 Non-current Assets Held for Sale and Discontinued Operations is not applied retrospectively if the valuations and other information required by the standard were not obtainable at the time the classification criteria were met.

Annual impairment tests for goodwill are performed during the fourth quarter of the year. If there is, however, an indication of impairment of goodwill, the impairment tests for goodwill are performed earlier during the financial year. Other assets of the Group are evaluated at the end of each reporting period or at any other time, if events or circumstances indicate that the value of an asset has been impaired. If there are indications of impairment, the asset’s recoverable amount is estimated, based on the higher of an asset’s fair value less costs to sell and value in use. An impairment loss is recognized in profit or loss whenever the carrying amount of an asset or cash generating unit exceeds its recoverable amount. If subsequently recording the impairment loss a positive change has occurred in the estimates of the recoverable amount, the impairment loss made in prior years is reversed no more than up to the value which would have been determined for the asset, net of amortization or depreciation, had not impairment loss been recognized in prior years. For goodwill, a recognized impairment loss is not reversed.

Cash flow projections have been calculated on the basis of reasonable and supportable assumptions. They are based on the most recent financial plans and forecasts that have been approved by management. Estimated cash flows are used for a maximum of five years. Cash flow projections beyond the period covered by the most recent plans and forecasts are estimated by extrapolating the projections. The discount rate is the weighted average cost of capital. It is a pre-tax rate and reflects current market assessments of the time value of money at the time of review and the risks related to the assets. Impairment of assets has been described in more detail in Note 13 to the consolidated financial statements.

Inventories are reported at the lower of cost and net realizable value. Cost is determined on a first in first out (FIFO) basis, or alternatively, weighted average cost. Net realizable value is the amount which can be realized from the sale of the asset in the normal course of business, after allowing for the estimated costs of completion and the costs necessary to make the sale.

The cost of finished goods and work in process includes materials, direct labor, other direct costs and a systematically allocated appropriate share of variable and fixed production overheads. As Glaston’s machine projects are usually not considered to be qualifying assets as defined in IAS 23, borrowing costs are not included in the cost of inventory in normal machine projects.

Used machines included in the inventory are measured individually so that the carrying amount of a used machine does not exceed the amount that is expected to be received from the sale of the machine. In this measurement the costs arising from converting the used machine back to saleable condition are taken into account.

Prototypes of new machines included in inventory are measured at the lower of cost and net realizable value.

Government or other grants are recognized in profit or loss in the same periods in which the corresponding expenses are incurred. Government grants received to acquire property, plant and equipment are reduced from the acquisition cost of the assets in question.

All leases over 12 months in length are recognized in the lessee’s statement of financial position. The lessee recognizes in the statement of financial position a right-of-use asset item, based on its right to use the said asset, and a lease liability item corresponding to the present value of the asset, based on the obligation to make the lease payments. IFRS 16 Leases contains exemptions for leases of 12 months or less and for assets of low value. Glaston adopts the exemptions permitted by IFRS 16 for leases of 12 months or less and for assets of low value and continues to treat them as other leases, and their costs are recognized as an expense on a straight-line basis.

Under IFRS 16 Leases, the amount of the right-of-use asset and the liability is calculated by discounting future minimum lease payments. The discount rate will primarily be the interest rate implicit in the lease, if available. In leases where the implicit interest rate is not specified, the discount rate used is the lessee’s incremental borrowing rate, the components of which are the currency-specific reference rate, the interest margin and any country or currency risk premium.

Glaston has leased machinery and equipment for production use, which have been treated as finance leases and for which a finance lease receivable has been recognized in the Group. The lessor’s leases are subdivided into finance leases and other leases.

A provision is recognized when as a consequence of some previous event there has arisen a legal or constructive obligation, and it is probable that this will cause future expenses and the amount of the obligation can be evaluated reliably.

A restructuring provision is booked only when a detailed and fully compliant plan has been prepared for it and implementation of the plan has been started or notification of it has been made known to those whom the arrangement concerns. The amount recognized as a provision is the best estimate of the expenditure required to settle the present obligation at the end of the reporting period. If the time value of money is material, provisions are discounted.

A provision for warranties is recognized when the underlying products are sold. The provision is estimated on the basis of historical warranty expense data. Warranty provision is presented as non-current or current provision depending on the length of the warranty period.

The amount and probability of provision requires management to make estimates and assumptions. Actual results may differ from these estimates.

Glaston’s reportable segments are Glaston Heat Treatment, Glaston Insulating Glass, Glaston Automotive & Emerging Technologies. The reportable segments comply with the group’s accounting and valuation principles. In inter-segment transactions, Glaston complies with the same commercial terms and conditions as in its third party transactions.

The reportable segments consist of operating segments, which have been aggregated in accordance with the criteria of IFRS 8.12. Operating segments have been aggregated, when the nature of the products and services is similar, the nature of the production process is similar as well as the type or class of customers. Glaston Group’s business consists of the manufacture and sale of glass processing machines as well as the service operations for these machines. There is a high level of integration between glass machines and maintenance. Their customers are the same, as is their market development, which is linked to the general development of the global market.

The reportable segment is disclosed in more detail in the Note 6 to the consolidated financial statements.

The preparation of financial statements in conformity with IFRS requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the end of the reporting period and the recognized amounts of revenues and expenses during the reporting period. Actual results may differ from these estimates.

In addition, management uses judgment in applying the accounting principles and in choosing the applicable accounting policies, if IFRS allow alternative methods.

The following items include critical accounting estimates: impairment testing of assets; estimated fair values of property, plant and equipment and intangible assets acquired in an acquisition and their estimated useful lives; useful lives of other intangible assets and property, plant and equipment; future economic benefits arising from capitalized development cost; measurement of inventories and trade and loan receivables; recognition and measurement of deferred taxes; estimates of the amount and probability of provisions and actuarial assumptions used in defined benefit plans.

The critical accounting estimates and judgments are described in more detail in Note 2 to the consolidated financial statements.

Dividends or return of capital proposed by the Board of Directors are not recorded in the financial statements until they have been approved by the shareholders at the Annual General Meeting.

Treasury shares acquired by the company and the related costs are presented as a deduction of equity. Gain or loss on surrender of treasury shares are recorded in reserve for invested unrestricted equity net of tax.

Basic earnings per share are calculated by dividing the net result attributable to owners of the parent by the weighted share-issue adjusted average number of shares outstanding during the year, excluding shares acquired by the Group and held as treasury shares.

Glaston’s order book includes the binding undelivered orders of the Group at the end of the reporting period. Orders for new machines and machinery upgrades are recognized in the order book only after receiving a binding agreement and either a down payment or a letter of credit.

Glaston’s orders received include the binding orders received and recognized in the order book during the reporting period as well as net sales of the service business, including net sales of spare parts. Machine upgrades, which belong to the service business, are included in orders received based on the binding orders received and recognized in the order book during the reporting period.