Financial Information

Key Figures

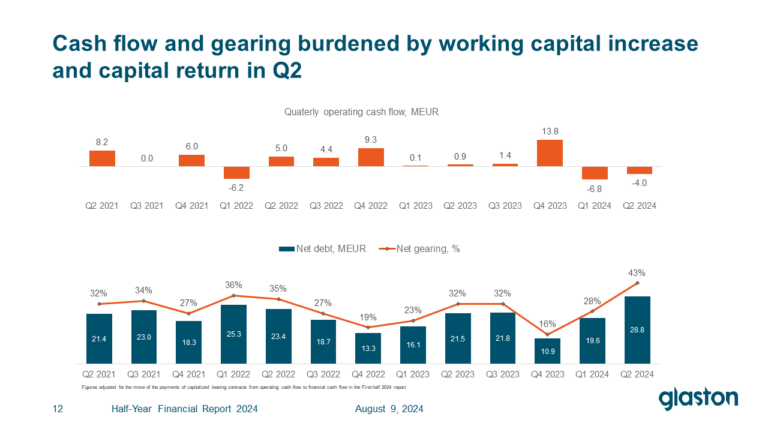

Below some key data from Q2 2024.

Financial Targets

Glaston’s medium-term (3-5 years) strategic targets:

- Annual average net sales growth (CAGR) exceeding the addressable equipment markets growth

- Comparable operating margin (EBITA) of 10%

- Comparable return on capital employed (ROCE) of above 16%

- Customer satisfaction score (Net Promoter Score, NPS) above 40.

- Group-wide zero lost time accidents target, progress measured by lost time accidents per million working hours (LTIFR).

- Employee Engagement target above 75 (out of 100).

- GHG emissions reduction targets:

- Reduce absolute scope 1 and 2 GHG emissions by 50% by 2032, compared to the 2022 base year (1,491 tCO2e).

- Reduce the scope 3 GHG emission intensity by 58% per square meter of sold processing capacity by 2032. Base year 2022: 0.0043 tCO2/m2.

Guidance

GLASTON SPECIFIES OUTLOOK FOR 2024

(published in the January-June 2024 financial report)

In the second quarter of the year, the cautious development in the architectural glass processing equipment markets continued. The earlier expected market recovery has been delayed and the markets are now anticipated to recover towards the end of 2024 at the earliest. For mobility glass processing equipment, the market in China is expected to grow with increased short-term volatility. Amid global economic uncertainty and continued geopolitical tensions, higher-than-normal uncertainty exists concerning customers’ decision-making.

Glaston Corporation specifies its outlook and estimates that its net sales will stay at the same level as in 2023. Comparable EBITA is estimated to amount to EUR 14.5−16.0 million. The net sales growth is curbed by the delayed market recovery whereas the planned structural cost-saving actions support profitability. In 2023, Group net sales totaled EUR 219.7 million and comparable EBITA was EUR 14.9 million.

(Previous outlook: Glaston Corporation estimates that its net sales and comparable EBITA will stay at the same level or increase slightly in 2024 from the levels reported for 2023.)

GLASTON’S OUTLOOK FOR 2024 REMAINS UNCHANGED

Published on May 3, 2024 in the Q1 2024 interim report

The cautious development in the architectural glass processing equipment markets continued in the first quarter of the year. Despite the slow start, Glaston expects the architectural glass processing equipment markets to start recovering at some point in 2024. For mobility glass processing equipment, the positive development in China is expected to continue. Amid global economic uncertainty and increased geopolitical tensions, higher-than-normal uncertainty exists concerning customers’ decision-making.

Glaston started the year with a lower order backlog than the previous year. However, given the expected slowly improving market activity during the year, Glaston Corporation estimates that its net sales and comparable EBITA will stay at the same level or increase slightly in 2024 from the levels reported for 2023. In 2023, Group net sales totaled EUR 219.7 million and comparable EBITA was EUR 14.9 million.

GLASTON’S OUTLOOK FOR 2024

(published on February 15,2024)

Amid early signs of increasing market activity, Glaston expects the architectural glass processing equipment markets to start recovering slowly at some point in 2024. In Europe, demand is expected to remain at the current level with the recovery taking place towards the end of the year. In the Americas, the current demand level is expected to continue. In China, demand in the Architectural market is expected to remain at a reasonable level. In the mobility glass processing equipment market, the cautiously positive development is expected to continue driven by China. With global economic uncertainty and geopolitical tensions continuing, higher-than-normal uncertainty exists in relation to customers’ decision-making.

Glaston starts the year with a lower order backlog than the previous year. However, given the expected improving market activity during the year, Glaston Corporation estimates that its net sales and comparable EBITA will stay at the same level or increase slightly in 2024 from the levels reported for 2023. In 2023, Group net sales totaled EUR 219.7 million and comparable EBITA was EUR 14.9 million.

Outlook as published in the Q3 2023 interim report 26 October 2023: Net sales estimate specified, comparable EBITA estimate unchanged

In the third quarter of 2023, the increasing market uncertainty and more cautious customer behavior continued. The activity in the architectural market further decreased, and the environment of softer demand is expected to continue in Europe and China also in the final quarter of the year. In the Americas, the demand prospects are better. Despite the softening of the markets, demand continues to be supported by the need to modernize existing equipment and the strong megatrends driving interest in energy-efficient glass solutions.

Throughout 2023, Glaston has focused on the execution of its strategy, which will incur costs and capital expenditure ahead of the effect on revenue growth. With ongoing geopolitical tensions and increasing uncertainty in the global business environment, a higher-than-normal level of unpredictability is related to customers’ investment decisions.

Due to the prevailing uncertainties, Glaston Corporation specifies its net sales estimate and expects net sales in 2023 to grow marginally or to be on the same level as reported for 2022. Glaston continues to estimate that comparable EBITA will increase to EUR 13.7−15.7 million. In 2022, the Group’s full-year net sales totaled EUR 213.5 million and comparable EBITA was EUR 13.6 million.

(Previous outlook: Despite the prevailing uncertainties, Glaston estimates that its net sales will increase in 2023 from the levels reported for 2022 and estimates comparable EBITA to increase to EUR 13.7−15.7 million.)

GLASTON SPECIFIES OUTLOOK FOR 2023

published in the H1 2023 report on 1 August 2023

In the first half of 2023, signs of increasing market uncertainty and more cautious customer behavior were visible. Due to the slowdown in the architectural market, the demand environment is expected to be softer in Europe and China during the rest of the year, while demand prospects are better in the Americas. Despite the softening of the markets, demand continues to be supported by the strong megatrends driving interest in energy-efficient glass solutions.

In 2023, Glaston has continued to focus on the execution of its strategy, which will incur costs and capital expenditure ahead of the effect on revenue growth. With ongoing geopolitical tensions and increasing uncertainty in the global business environment, a higher-than-normal level of unpredictability is related to customers’ investment decisions.

Glaston’s net sales and profitability development in 2023 continue to be supported by a healthy order backlog.

Despite the prevailing uncertainties, Glaston Corporation estimates that its net sales will increase in 2023 from the levels reported for 2022 and specifies its outlook for comparable EBITA, which is estimated to increase to EUR 13.7−15.7 million. In 2022, the Group’s full-year net sales totaled EUR 213.5 million and comparable EBITA was EUR 13.6 million.

(Previous outlook: Glaston Corporation estimates that its net sales and comparable EBITA will improve in 2023 from the levels reported for 2022.)

GLASTON’S OUTLOOK FOR 2023 REMAINS UNCHANGED

published in the Q1/2023 interim report on 26 April 2023

In 2023, Glaston expects the markets to remain active despite some regional differences. The strong megatrends driving the demand for energy-efficient glass solutions continue to support Glaston’s markets. Europe could however be particularly affected by the slowdown in the architectural market. In the Americas, Glaston expects the demand to continue strong, whereas, in China, the prospects of the architectural market remain uncertain.

In 2023, Glaston continues to focus on the execution of its strategy, which will incur costs and capital expenditure ahead of the effect on revenue growth. Amid geopolitical tensions and increasing uncertainty in the global business environment, the higher-than-normal level of unpredictability is related to customers’ investment decisions.

Glaston entered 2023 with an order backlog 46 % higher than in the previous year, which supports the company’s net sales and profitability development. The Automotive production ramp-up in China continues to have a negative impact on profitability in the second quarter of 2023. Glaston Corporation estimates that its net sales and comparable EBITA will improve in 2023 from the levels reported for 2022. In 2022, Group full-year net sales totaled EUR 213.5 million and comparable EBITA was EUR 13.6 million.

GLASTON’S OUTLOOK FOR 2023

as in the Financial Statements Bulletin on 9 February 2023

In 2023, Glaston expects the overall market activity to remain at a good level despite some regional differences. Although the megatrends support the use of energy-efficient windows, demand in Europe could be affected by the slowdown in the architectural market. In the Americas, Glaston expects the demand to continue strong, whereas in China, the prospects of the architectural market are uncertain.

In 2023, Glaston continues to focus on the execution of its strategy, which will incur costs and capital expenditure ahead of the effect on revenue growth. As supply chain disturbances and geopolitical tensions continue, a higher-than-normal uncertainty is related to the development of economic activity and customers’ investments.

Glaston entered 2023 with an order backlog 46% higher than in the previous year. This provides a strong starting point for 2023 and supports the company’s net sales and profitability development. Glaston Corporation estimates that its net sales and comparable EBITA will improve in 2023 from the levels reported for 2022. As is typical, Glaston expects the first quarter of 2023 to be the weakest of the year, additionally impacted by low upgrade net sales and a higher share of new products. In 2022, Group full-year net sales totaled EUR 213.5 million and comparable EBITA was EUR 13.6 million.

GLASTON SPECIFIES OUTLOOK FOR 2022

(published in the January-September 2022 report on 27 October 2022)

In the third quarter, overall demand in most of Glaston’s markets remained strong, which indicates good development for machines and services businesses for the coming quarters. Glaston began 2022 with a solid order backlog. The strong order intake in January−September further supports Glaston’s 2022 full-year net sales and profitability development. Costs and capital expenditure related to the execution of the updated Group strategy, announced in August 2021, will occur ahead of the effect on revenue growth.

Contrary to the overall strong market demand, inflation, energy cost increases, raw material prices, and the slowdown in economic growth are causing hesitation among some customers in their investment decisions. Supply chain disturbances are expected to continue, which means higher than normal uncertainty over Glaston’s short-term net sales and profitability development. Despite an improved situation, the impact of the COVID-19 pandemic cannot be fully ruled out, especially in China.

(Previous outlook: Despite the prevailing uncertainties, Glaston Corporation estimates that its net sales will increase in 2022 from the levels reported for 2021 and specifies its outlook for comparable EBITA, which is estimated to increase to EUR 12−15 million. In 2021, Group net sales totaled EUR 182.7 million and comparable EBITA was EUR 11.1 million.)

GLASTON SPECIFIES OUTLOOK FOR 2022

(published in the half-year January-June 2022 report on 4 August 2022)

During the first half of 2022, the overall demand in most of Glaston’s markets remained strong, indicating good development for machines and services businesses. In 2022, Glaston’s net sales and profitability development are supported by the solid order backlog at the beginning of the year as well as healthy order intake during the first half of 2022. Costs and capital expenditure related to the execution of the refined Group strategy, announced in August 2021, will occur ahead of the effect on revenue growth.

Currently, higher than usual uncertainty is related to the development of global economic activity and customers’ investments. The uncertainty is driven by, in particular, the supply chain disturbances, which have become a longer-term challenge, and the Russian attack on Ukraine with its implications for energy and raw material prices. The impacts of the still ongoing COVID-19 pandemic add to the uncertainty, especially in China.

Despite the the prevailing uncertainties, Glaston Corporation estimates that its net sales will increase in 2022 from the levels reported for 2021 and specifies its outlook for comparable EBITA, which is estimated to increase to EUR 12−15 million. In 2021, Group net sales totaled EUR 182.7 million and comparable EBITA was EUR 11.1 million.

GLASTON’S OUTLOOK FOR 2022

(published in the January-March Interim Report 27 April 2022)

In 2021, Glaston’s markets saw a strong recovery and growth. This positive development continued in the first quarter of 2022, indicating good development for both machines and services business. Glaston started the year with a 48% higher order backlog than in 2021, which supports Glaston’s net sales and profitability development. In 2022, Glaston is focusing on the execution of its strategy, which will incur costs and capital expenditure ahead of the effect on revenue growth.

Currently, higher than normal uncertainty is related to the development of economic activity and customers’ investments. The uncertainty is driven by several simultaneous factors, such as the supply chain disturbances that have become a longer-term challenge, the Russian invasion of Ukraine with its implications on energy and raw material prices, and the still ongoing COVID-19 pandemic.

Despite the prevailing uncertainties, Glaston Corporation expects market development to continue to be positive and estimates that its net sales and comparable EBITA will improve in 2022 from the levels reported for 2021. In 2021, Group net sales totaled EUR 182.7 million and comparable EBITA was EUR 11.1 million.

GLASTON’S OUTLOOK FOR 2022

(as published in the Financial Statements on 14 February 2022)

In 2021, Glaston’s markets saw a continued recovery and strong growth. We expect positive development to continue in 2022 with good progress for both machines and services business. At the start of 2022, our order backlog was 48% higher than the previous year providing a strong starting point for 2022 and supporting Glaston’s net sales and profitability development. In 2022, Glaston will focus on the execution of its strategy which will incur costs and capital expenditure ahead of the effect on revenue growth. As the COVID-19 pandemic continues and supply chain disturbances have become a longer-term challenge, a higher than normal uncertainty is related to the development of economic activity and customers’ investments.

Glaston Corporation estimates that its net sales and comparable EBITA will improve in 2022 from the levels reported for 2021. In 2021, Group net sales totaled EUR 182.7 million and comparable EBITA was EUR 11.1 million.

Dividend

| 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | |

| Dividend per share | 0.05*) | 0.04* | 0.03*) | 0.02*) | - | 0.03*) | 0.01*) | - | 0.01*) |

| Extra dividend per share | - | - | - | - | - | - | - | - | - |

| Total dividend | 0.05 | 0.04 | 0.03 | 0.02 | - | 0.03 | 0.01 | - | 0.01 |

*) return of capital

Dividend policy

According to Glaston’s dividend policy Glaston’s objective is to distribute annually a dividend or return of capital amounting to 30-50% of the company’s comparable earnings per share.

When determining the amounts and dates of payment of any future dividends or returns of capital the Board of Directors always takes the company’s financial position and future outlook into consideration. In addition, the dividend policy takes into account growth targets in line with strategy as well as financing requirements for growth.

Accounting Principles

Glaston Corporation is a public limited liability company organized under the laws of the Republic of Finland and domiciled in Helsinki, Finland. Glaston’s shares are publicly traded in Nasdaq Helsinki Ltd. Small Cap in Helsinki, Finland. Glaston Corporation is the parent of Glaston Group and its registered office is at Lönnrotinkatu 11, 00120 Helsinki, Finland.

Glaston Group is an international glass technology company. Glaston is one of the leading manufacturers of glass processing machines globally. Its product range and service network are the most extensive in the industry. From October 1, 2023, the operations of Glaston Group are organized in two reportable segments which consists of operating segments.

The consolidated financial statements of Glaston Group are prepared in accordance with International Financial Reporting Standards (IFRS), including International Accounting Standards (IAS) and Interpretations issued by the International Financial Reporting Interpretations Committee (SIC and IFRIC). International Financial Reporting Standards are standards and their interpretations adopted in accordance with the procedure laid down in regulation (EC) No 1606/2002 of the European Parliament and of the Council. The Notes to the Financial Statements are also in accordance with the Finnish Accounting Act and Ordinance and the Finnish Companies’ Act.

The consolidated financial statements include the financial statements of Glaston Corporation and its subsidiaries. The functional and reporting currency of the parent is euro, which is also the reporting currency of the consolidated financial statements. Functional currencies of subsidiaries are determined by the primary economic environment in which they operate.

The financial year of Glaston Group as well as of the parent and subsidiaries is the calendar year ending 31 December.

The financial statements have been prepared under the historical cost convention except as disclosed in the accounting policies below. The figures in Glaston’s consolidated financial statements are mainly presented in EUR thousands. Due to rounding differences the figures presented in tables do not necessarily add up to the totals of the tables.

In addition to the standards and interpretations presented in the financial statements for 2020, the Group will adopt IFRS standards, IFRIC interpretations and changes to existing standards and interpretations that enter into effect in 2021. Management estimates that these will have no material effect on Glaston’s consolidated financial statements.

The consolidated financial statements include the parent and its subsidiaries. Subsidiaries are companies in which the parent has, based on its holding, more than half of the voting rights directly or via its subsidiaries or over which it otherwise has control. Divested subsidiaries are included in the consolidated financial statements until the control is lost, and companies acquired during the reporting period are included from the date when the control has been transferred to Glaston. Acquisitions of subsidiaries are accounted for under the purchase method.

Associates, where the Group has a significant influence (holding normally 20–50 per cent), are accounted for using the equity method. The Group’s share of the associates’ net results for the financial year is recognized as a separate item in profit or loss. The Group’s interest in an associate is carried in the statement of financial position at an amount that reflects its share of the net assets of the associate together with goodwill on acquisition, if such goodwill exists. When the Group’s share of losses exceeds the carrying amount of associate, the carrying amount is reduced to nil and recognition of further losses ceases unless the Group is committed to satisfy obligations of the associate by guarantees or otherwise. Glaston Group has no associates in years 2020 and 2019.

Other shares, i.e. shares in companies in which Glaston owns less than 20 percent of voting rights, are classified as assets recognized at fair value through other comprehensive income, or if the fair value cannot be measured reliably, at acquisition cost, and dividends received from them are recognized in profit or loss.

All inter-company transactions are eliminated as part of the consolidation process. Unrealized gains arising from transactions with associates are eliminated to the extent of the Group’s interest in the entity. Unrealized losses are eliminated in the similar way as unrealized gains, but only to the extent that there is no evidence of impairment.

Non-controlling interests are presented separately in arriving at the net profit or loss attributable to owners of the parent. They are also shown separately within equity. If the Group has a contractual obligation to redeem the share of the non-controlling interest with cash or cash equivalents, non-controlling interest is classified as a financial liability. The effects of the transactions made with non-controlling interests are recognized in equity, if there is no change in control. These transactions do not result in goodwill or gains or losses. If the control is lost, the possible remaining ownership share is measured at fair value and the resulting gain or loss is recognized in profit or loss. Total comprehensive income is attributed also to non-controlling interest even if this will result in the non-controlling interest having a deficit balance.

In the consolidated financial statements, statements of profit or loss, statements of comprehensive income and statements of cash flows of foreign subsidiaries have been translated into euros using the average exchange rates of the reporting period and the statements of financial positions have been translated using the closing exchange rates at the end of the reporting period.

The exchange difference arising from translating the statements of profit or loss, statements of comprehensive income and statements of financial position using the different exchange rates is recognized as other comprehensive income and included in equity as cumulative exchange difference. Exchange differences arising from the translation of the net investments in foreign subsidiaries and associates in non-euro-area are also recognized in other comprehensive income and included in equity as cumulative exchange difference.

On the disposal of all or part of a foreign subsidiary or an associate, the cumulative amount or proportionate share of the exchange difference is reclassified from equity to profit or loss as a reclassification item in the same period in which the gain or loss on disposal is recognized.

In their own day-to-day accounting the Group companies translate transactions in foreign currencies into their own reporting or functional currency at the exchange rates prevailing on the dates of the transactions. At the end of the reporting period, the unsettled balances of foreign currency transactions are measured at the exchange rates prevailing at the end of the reporting period. Foreign exchange gains and losses arising from trade receivables are entered as adjustments of net sales and foreign exchange gains and losses related to trade payables are recorded as adjustments of purchases. Foreign exchange gains and losses arising from financial items are recorded as financial income and expenses.

Glaston’s financial assets have been classified into three categories: as assets recognized at amortized cost, at fair value through other comprehensive income and at fair value through profit or loss. The classification depends on the business model under which the financial assets are managed as well as the characteristics of the instrument’s cash flows. A financial asset item is derecognized from the statement of financial position when Glaston’s contractual right to the cash flows from the financial asset item expire or the financial asset item is transferred to an external party and the transfer fulfills the asset derecognition requirements of IFRS 9.

Financial liabilities are classified at amortized cost using the effective interest method, or at fair value through profit or loss. A financial liability or part of a financial liability is derecognized from the statement of financial position when the liability has ceased to exist, i.e. when the obligation specified in the contract has been discharged or canceled or has expired.

Derivative contracts are entered in the statement of financial position at the time of acquisition at fair value and remeasured at fair value in the financial statements using the market prices at the end of the reporting period. Entries of the changes of derivatives are influenced by whether a derivative contract falls within the scope of hedge accounting. Derivatives that do not meet the hedge accounting conditions are financial assets and liabilities acquired for trading and entered at fair value through profit or loss, and whose changes of value are recognized immediately through profit or loss.

When a hedging arrangement is entered into, the relationship between the item being hedged and the hedging instrument, as well as the objectives of the Group’s risk management are documented. The IFRS 9 standard requires an economic relationship between the hedged item and the hedging instrument as well as the same hedge ratio that management actually uses in risk management.

If the hedging accounting conditions are met, cash flow hedge accounting under IAS 9 is applied with respect to foreign exchange derivatives. If the hedge accounting conditions are not met, the result of hedging instruments when hedging a commercial foreign exchange risk are recognized in profit or loss within other operating income or expenses.

Derivative instruments are included in the statement of financial position in current assets and liabilities. Trade date accounting is used in recognizing sales and purchases of derivatives.

In reporting periods 2020 and 2019, hedge accounting was used in hedging the trade receivables of projects. At the end of reporting periods 2020 and 2019, Glaston had open foreign exchange forward contracts.

Other assets recognized at fair value through profit or loss may include current investments that are acquired and held for trading, i.e. acquired or incurred for the main purpose of selling them in the short term. Other assets recognized at fair value through profit or loss are included in current assets in the statement of financial position.

Fair values of other financial assets recognized at fair value through profit or loss are estimated to correspond to their carrying amounts because of their short maturities. Trade date accounting is used in recognizing purchases and sales of other assets recognized at fair value through profit or loss.

Loans and other receivables are assets which are not included in derivative assets. Loans and other receivables arise when money, goods or services are delivered to a debtor. They are not quoted in an active market and payments related to them are either fixed or determinable. Loans and receivables granted by the Group are measured at amortized cost.

Loan receivables, trade receivables and other receivables have been classified as loans and other receivables. They are included in current or non-current financial assets in accordance with their maturity. Loan and trade receivables falling due after 12 months are discounted, if no interest is charged separately, and the increase in the receivable which reflects the passage of time is recognized as interest income in financial income and expenses.

Trade receivables are carried at the original invoice amount less the share of the discounted interest and an estimate made for doubtful receivables. The estimate made for doubtful receivables is based on a review of all trade receivables outstanding on the reporting date as well as on an assessment of the impairment of financial assets based on expected credit losses. Impairment losses of trade receivables are recorded in a separate allowance account within trade receivables, and the impairment losses are recognized in profit or loss as other operating expenses. If the impairment loss is final, the trade receivable is derecognized from the allowance account. If a payment is later received from the impaired receivable, the received amount is recognized in profit or loss as a deduction of other operating expenses. If no impairment loss has been recognized in allowance account and the impairment loss of the trade receivable is found to be final, impairment loss is recognized directly as deduction of trade receivables.

Loan receivables are carried at the original amount less an estimate made for doubtful receivables. The estimate made for doubtful receivables is based on a separate review of all loan receivables outstanding on the reporting date as well as on an assessment of the impairment of financial assets based on expected credit losses. For example, payment defaults or late payments are considered as indications of impairment of the receivable. Impairment losses of loan receivables are recognized in profit or loss as financial expenses. If a payment is later received from the impaired receivable, the received amount is recognized in profit or loss in financial items.

Financial assets measured at fair value through other comprehensive income are financial assets not included in derivative assets, assets or liabilities recognized at fair value through profit or loss, or other receivables.

Listed investments included in financial assets measured at fair value through other comprehensive income are valued at the market price at the end of the reporting period. Investments whose fair value cannot be reliably determined, such as unlisted shares and other investments, are stated at acquisition cost or lower if an impairment loss is recognized for the investment.

Unrealized changes in the fair value of financial assets measured at fair value through other comprehensive income are recognized in other comprehensive income less tax effects and are included in the fair value reserve in equity.

Financial assets at fair value through other comprehensive income are included in non-current assets in the statement of financial position.

Cash and cash equivalents comprise cash and other financial assets. Other financial assets are highly liquid investments with remaining maturities at the date of acquisition of three months or less. Bank overdrafts are included in current interest-bearing liabilities.

On initial recognition financial liabilities are measured at their fair values that are based on the consideration received. Subsequently, financial liabilities are measured at amortized cost using the effective interest method. Transaction costs are included in the acquisition cost.

Financial liabilities measured at amortized cost include pension loans, loans from financial institutions, finance lease liabilities, debenture bond, trade payables and advances received. They are included in current or non-current liabilities in accordance with their maturity.

Interest expenses are accrued for and mainly recognized in profit or loss for each period. If an asset is a qualifying asset as defined in IAS 23 Borrowing Costs, the borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset are capitalized to the acquisition cost of the asset. The capitalization applies mainly to property, plant and equipment and intangible assets.

Net sales include the total invoicing value of products sold and services provided less discounted interest and sales tax, cash discounts and rebates. Foreign exchange differences arising from trade receivables are recognized as sales adjustments.

Revenue from the sale of goods is recognized at a specific date or within a certain period, according to when the buyer receives the goods or gains control. Normally, this takes place at the date of the delivery in accordance with the terms of delivery. Revenue from services rendered and repair work is recognized when the service has been rendered or the work has been completed. Revenue is recognized in an amount that reflects the consideration to which the entity expects to be entitled in exchange for goods delivered or services rendered.

In satisfying the terms of IFRS 15, Glaston recognizes the revenue from tailor-made glass processing machine deliveries over time (partial revenue recognition). As a revenue recognition practice, Glaston applies the cost-to-cost method, i.e. the share of accumulated project costs compared to total estimated costs is used as the degree of completion. Revenue recognition takes place over time, according to when costs accumulate and are recognized for the project.

The Group has various pension plans in accordance with the local conditions and practices in the countries where it operates. The pension plans are classified as defined contribution plans or defined benefit plans. The payments to the schemes are determined by actuarial calculations.

The contributions to defined contribution plans are charged to profit or loss in the period to which the contributions relate.

The obligations for defined benefit plans have been calculated separately for each plan. Defined benefit liabilities or assets, which have arisen from the difference between the present value of the obligations and the fair value of plan assets, have been entered in the statement of financial position.

The defined benefit obligation is measured as the present value of the estimated future cash flows using interest rates of government securities that have maturity terms approximating the terms of related liabilities or similar long-term interests.

For the defined benefit plans, costs are assessed using the projected unit credit method. Under this method the cost is charged to profit or loss so as to spread over the service lives of employees.

According to the standard Glaston records actuarial gains and losses in other comprehensive income. Only current and past service costs as well as net interest on net defined benefit liability can be recorded in profit or loss. Other changes in net defined benefit liability are recognized in other comprehensive income with no subsequent recycling to profit or loss.

Glaston Corporation has share-based incentive plans for the Group’s key personnel. Depending on the plan, the reward is settled in shares, cash, or a combination thereof, provided that the key employee’s employment or service with the Group is in force and the criteria for the performance is fulfilled. If a key employee’s employment or service with the Group ends before the payment of a reward, the main principle is that no reward will be paid.

The granted amount of the incentive plans settled in shares is measured at fair value at the grant date, and the cash-settled part of the plans is measured at fair value at the reporting or payment date.

The expenses arising from the incentive plans are recognized in profit or loss during the vesting periods. The cash-settled portion of the incentive plans is recorded as a liability in the statement of financial position, if it has not been paid, and the portion settled in shares is recorded in retained earnings in equity net of tax. Glaston records the personnel costs arising from the share-based incentive plans to the extent it is liable to pay them. The share-based incentive plans are described in Note 30 to the consolidated financial statements.

The consolidated financial statements include current taxes, which are based on the taxable results of the group companies for the reporting period together with tax adjustments for previous reporting periods, calculated in accordance with the local tax rules, and the change in the deferred tax liabilities and assets.

Income taxes which relate to items recognized in other comprehensive income are therefore recognized in other comprehensive income.

The Group’s deferred tax liabilities and assets have been calculated for temporary differences, which have been obtained by comparing the carrying amount of each asset or liability item with their tax bases. Deferred tax assets are recognized for deductible temporary differences and tax losses to the extent that it is probable that taxable profit will be available, against which tax credits and deductible temporary differences can be utilized. In calculating deferred tax liabilities and assets, the tax rate used is the tax rate in force at the time of preparing the financial statements or which has been enacted by end of the reporting period.

Principal temporary differences arise from depreciation and amortization of property, plant and equipment and intangible assets, defined benefit plans, recognition of net assets of acquired companies at fair value, through other comprehensive income and derivative instruments at fair value, inter-company inventory profits, share-based payments and confirmed tax losses.

Items affecting comparability are adjusted for non-business transactions or changes in valuation items when they arise from restructuring, acquisitions and disposals, related integration and separation costs, sale or impairment of assets. These may include staff reductions, rationalization of the product range, restructuring of the production structure, and reduction of premises.

Impairment losses on goodwill, gains or losses on disposals due to changes in the group structure, exceptionally large gains or losses on tangible and intangible assets, exceptional compensations for damages and legal proceedings are restated as an item affecting comparability. Additionally large gains or losses on tangible and intangible assets, exceptional compensations for damages and legal proceedings are restated as an item affecting comparability.

Intangible asset is recognized in the statement of financial position if its cost can be measured reliably and it is probable that the expected future economic benefits attributable to the asset will flow to the Group. Intangible assets are stated at cost and amortized on a straight line basis over their estimated useful lives. Intangible assets with indefinite useful life are not amortized, but tested annually for impairment.

Acquired intangible assets recognized as assets separately from goodwill are recorded at fair value at the time of the acquisition of the subsidiary.

The estimated useful lives for intangible assets are as follows:

Computer software, patents,

licenses, trademarks, product rights 3-10 years

Capitalized development expenditure 5-7 years

Other intangible assets 5-10 years

Research costs are expensed as incurred. Expenditure on development activities, whereby research findings are applied to a plan or design for the production of new or substantially improved products, is capitalized if the product is technically and commercially feasible and the Group has sufficient resources to complete development and to use or sell the intangible asset. Amortization of the capitalized expenditure starts when the asset is available for use. The intangible assets not yet available for use are tested annually for impairment. Research expenditure and development expenditure recognized in profit or loss are recognized in operating expenses.

Borrowing costs are capitalized as part of the acquisition cost of intangible assets if the intangible assets are qualifying assets as defined in IAS 23 Borrowing Costs. In 2020 or 2019 Glaston did not have any qualifying assets.

Goodwill represents the excess of the acquisition cost over fair value of the assets less liabilities of the acquired entity. Goodwill arising from the acquisition of foreign entities of acquisitions is treated as an asset of the foreign entity and translated at the closing exchange rates at the end of the reporting period.

Acquisitions have been recognized in accordance with IFRS 3. Purchase consideration has been allocated to intangible assets, if they have met the recognition criteria stated in IAS 38 (Intangible Assets).

In accordance with IFRS 3 Business Combinations, goodwill is not amortized. The carrying amount of goodwill is tested annually for impairment. The testing is made more frequently if there are indications of impairment of the goodwill. Any possible impairment loss is recognized immediately in profit or loss.

Glaston’s goodwill has been allocated to the cash generating units of the group.

Property, plant and equipment are stated at historical cost less accumulated depreciation and impairment losses. The cost of self-constructed assets includes the cost of materials, direct labor and an appropriate proportion of production overheads. When an asset consists of major components with different useful lives, they are accounted for as separate items. Assets from acquisition of a subsidiary are stated at their fair values at the date of the acquisition.

Depreciation is recorded on a straight-line basis over expected useful lives. Land is not depreciated since it is deemed to have indefinite useful life.

The most common estimated useful lives are as follows:

Buildings and structures 25-40 years

Heavy machinery 10-15 years

Other machinery and equipment 3-5 years

IT equipment 3-10 years

Other tangible assets 5-10 years

The buildings include the investment property which is part of the plant situated in Tianjin, China. This is reported as investment property and has been leased since 2016 under a 10-year agreement.

Gain on the sale of property, plant and equipment is included in other operating income and loss in operating expenses.

The costs of major inspections or the overhaul of property, plant and equipment items, that occur at regular intervals and are identified as separate components, are capitalized and depreciated over their useful lives. Ordinary maintenance and repair charges are expensed as incurred.

Borrowing costs are capitalized as part of the acquisition cost of tangible assets if the tangible assets are qualifying assets as defined in IAS 23 Borrowing Costs. In 2020 or 2019 Glaston did not have any qualifying assets.

A discontinued operation is a segment or a unit representing a significant geographical area, which has been disposed of or is classified as held for sale. The profit for the period attributable to the discontinued operation is presented separately in the consolidated statement of profit or loss. Also post-tax gains and losses recognized on the measurement to fair value less costs to sell or on the disposal of the asset or disposal group are presented in the statement of profit or loss as result of discontinued operations. Comparative information has been restated.

Non-current assets or disposal groups are classified as held for sale and presented separately in the statement of financial position if their carrying amounts will be recovered principally through a sale transaction rather than through continuing use. In order to be classified as held for sale the asset or disposal group must be available for immediate sale in its present condition and the sale must be highly probable. In addition, the sale should qualify for recognition of a complete sale within one year from the date of the classification.

An asset classified as held for sale is measured at the lower of its carrying amount and fair value less costs to sell and it is not depreciated or amortized.

Also liabilities of a disposal group classified as held for sale are presented separately from other liabilities in the statement of financial position.

IFRS 5 Non-current Assets Held for Sale and Discontinued Operations is not applied retrospectively if the valuations and other information required by the standard were not obtainable at the time the classification criteria were met.

Annual impairment tests for goodwill are performed during the fourth quarter of the year. If there is, however, an indication of impairment of goodwill, the impairment tests for goodwill are performed earlier during the financial year. Other assets of the Group are evaluated at the end of each reporting period or at any other time, if events or circumstances indicate that the value of an asset has been impaired. If there are indications of impairment, the asset’s recoverable amount is estimated, based on the higher of an asset’s fair value less costs to sell and value in use. An impairment loss is recognized in profit or loss whenever the carrying amount of an asset or cash generating unit exceeds its recoverable amount. If subsequently recording the impairment loss a positive change has occurred in the estimates of the recoverable amount, the impairment loss made in prior years is reversed no more than up to the value which would have been determined for the asset, net of amortization or depreciation, had not impairment loss been recognized in prior years. For goodwill, a recognized impairment loss is not reversed.

Cash flow projections have been calculated on the basis of reasonable and supportable assumptions. They are based on the most recent financial plans and forecasts that have been approved by management. Estimated cash flows are used for a maximum of five years. Cash flow projections beyond the period covered by the most recent plans and forecasts are estimated by extrapolating the projections. The discount rate is the weighted average cost of capital. It is a pre-tax rate and reflects current market assessments of the time value of money at the time of review and the risks related to the assets. Impairment of assets has been described in more detail in Note 13 to the consolidated financial statements.

Inventories are reported at the lower of cost and net realizable value. Cost is determined on a first in first out (FIFO) basis, or alternatively, weighted average cost. Net realizable value is the amount which can be realized from the sale of the asset in the normal course of business, after allowing for the estimated costs of completion and the costs necessary to make the sale.

The cost of finished goods and work in process includes materials, direct labor, other direct costs and a systematically allocated appropriate share of variable and fixed production overheads. As Glaston’s machine projects are usually not considered to be qualifying assets as defined in IAS 23, borrowing costs are not included in the cost of inventory in normal machine projects.

Used machines included in the inventory are measured individually so that the carrying amount of a used machine does not exceed the amount that is expected to be received from the sale of the machine. In this measurement the costs arising from converting the used machine back to saleable condition are taken into account.

Prototypes of new machines included in inventory are measured at the lower of cost and net realizable value.

Government or other grants are recognized in profit or loss in the same periods in which the corresponding expenses are incurred. Government grants received to acquire property, plant and equipment are reduced from the acquisition cost of the assets in question.

All leases over 12 months in length are recognized in the lessee’s statement of financial position. The lessee recognizes in the statement of financial position a right-of-use asset item, based on its right to use the said asset, and a lease liability item corresponding to the present value of the asset, based on the obligation to make the lease payments. IFRS 16 Leases contains exemptions for leases of 12 months or less and for assets of low value. Glaston adopts the exemptions permitted by IFRS 16 for leases of 12 months or less and for assets of low value and continues to treat them as other leases, and their costs are recognized as an expense on a straight-line basis.

Under IFRS 16 Leases, the amount of the right-of-use asset and the liability is calculated by discounting future minimum lease payments. The discount rate will primarily be the interest rate implicit in the lease, if available. In leases where the implicit interest rate is not specified, the discount rate used is the lessee’s incremental borrowing rate, the components of which are the currency-specific reference rate, the interest margin and any country or currency risk premium.

Glaston has leased machinery and equipment for production use, which have been treated as finance leases and for which a finance lease receivable has been recognized in the Group. The lessor’s leases are subdivided into finance leases and other leases.

A provision is recognized when as a consequence of some previous event there has arisen a legal or constructive obligation, and it is probable that this will cause future expenses and the amount of the obligation can be evaluated reliably.

A restructuring provision is booked only when a detailed and fully compliant plan has been prepared for it and implementation of the plan has been started or notification of it has been made known to those whom the arrangement concerns. The amount recognized as a provision is the best estimate of the expenditure required to settle the present obligation at the end of the reporting period. If the time value of money is material, provisions are discounted.

A provision for warranties is recognized when the underlying products are sold. The provision is estimated on the basis of historical warranty expense data. Warranty provision is presented as non-current or current provision depending on the length of the warranty period.

The amount and probability of provision requires management to make estimates and assumptions. Actual results may differ from these estimates.

Glaston’s reportable segments are Glaston Heat Treatment, Glaston Insulating Glass, Glaston Automotive & Emerging Technologies. The reportable segments comply with the group’s accounting and valuation principles. In inter-segment transactions, Glaston complies with the same commercial terms and conditions as in its third party transactions.

The reportable segments consist of operating segments, which have been aggregated in accordance with the criteria of IFRS 8.12. Operating segments have been aggregated, when the nature of the products and services is similar, the nature of the production process is similar as well as the type or class of customers. Glaston Group’s business consists of the manufacture and sale of glass processing machines as well as the service operations for these machines. There is a high level of integration between glass machines and maintenance. Their customers are the same, as is their market development, which is linked to the general development of the global market.

The reportable segment is disclosed in more detail in the Note 6 to the consolidated financial statements.

The preparation of financial statements in conformity with IFRS requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the end of the reporting period and the recognized amounts of revenues and expenses during the reporting period. Actual results may differ from these estimates.

In addition, management uses judgment in applying the accounting principles and in choosing the applicable accounting policies, if IFRS allow alternative methods.

The following items include critical accounting estimates: impairment testing of assets; estimated fair values of property, plant and equipment and intangible assets acquired in an acquisition and their estimated useful lives; useful lives of other intangible assets and property, plant and equipment; future economic benefits arising from capitalized development cost; measurement of inventories and trade and loan receivables; recognition and measurement of deferred taxes; estimates of the amount and probability of provisions and actuarial assumptions used in defined benefit plans.

The critical accounting estimates and judgments are described in more detail in Note 2 to the consolidated financial statements.

Dividends or return of capital proposed by the Board of Directors are not recorded in the financial statements until they have been approved by the shareholders at the Annual General Meeting.

Treasury shares acquired by the company and the related costs are presented as a deduction of equity. Gain or loss on surrender of treasury shares are recorded in reserve for invested unrestricted equity net of tax.

Basic earnings per share are calculated by dividing the net result attributable to owners of the parent by the weighted share-issue adjusted average number of shares outstanding during the year, excluding shares acquired by the Group and held as treasury shares.

Glaston’s order book includes the binding undelivered orders of the Group at the end of the reporting period. Orders for new machines and machinery upgrades are recognized in the order book only after receiving a binding agreement and either a down payment or a letter of credit.

Glaston’s orders received include the binding orders received and recognized in the order book during the reporting period as well as net sales of the service business, including net sales of spare parts. Machine upgrades, which belong to the service business, are included in orders received based on the binding orders received and recognized in the order book during the reporting period.